Yesterday, the House voted for a clean debt limit increase. If you're one of those people worrying about the fragility of the economic recovery, or one of the many more actually struggling with it, this might have sounded promising to you. In fact, a clean increase is the way to go.

Yes, we need to get on a sustainable budget path, and yes, that's going to take some serious haggling between the parties. Such haggling needs to occur, but it takes time, and the clock is ticking.

In the interest on not endangering an economy that really doesn't need anything else to worry about, first raise the ceiling, then debate the budget. What's more important right now, gaining political leverage, or getting the economy back on track so people can get back to work?

It's a rhetorical question. This was not a vote about doing the right thing. It was theater...you know, like Shakespearean tragedy.

As my CBPP colleague Jim Horney put it:

Yes, we need to get on a sustainable budget path, and yes, that's going to take some serious haggling between the parties. Such haggling needs to occur, but it takes time, and the clock is ticking.

In the interest on not endangering an economy that really doesn't need anything else to worry about, first raise the ceiling, then debate the budget. What's more important right now, gaining political leverage, or getting the economy back on track so people can get back to work?

It's a rhetorical question. This was not a vote about doing the right thing. It was theater...you know, like Shakespearean tragedy.

As my CBPP colleague Jim Horney put it:

House Republican leaders scheduled the clean debt limit increase vote for one reason: to defeat it. They believe this will support their strategy of holding a debt limit increase hostage to enactment of a deficit-reduction package they favor that would impose deep cuts in Medicare, Medicaid, and other important programs while protecting Bush-era tax cuts for the wealthiest taxpayers and various dubious tax breaks for large corporations and other special interests.

The vote went down, big time. Here's Rep. Dave Camp, one of the leaders of the Republican's strategy: "This vote, based on legislation I've introduced, will and must fail."

Thanks, Dave. One just doesn't know what to say to that. I fear we're past the point where facts matter in this debate, but, sticking with Shakespeare, "once more unto the breach."

I have lately been focusing on all the soft spots in the current economy, with particular focus of thelabor market, since that's where most working-age families are either going to start gaining some economic traction or continue slogging through a recovery that doesn't look all that different from recession to too many families.

Anyone who wants to understand the stakes here should focus on the first graph from that link above--the sharp decline, and lack of recovery, in the share of the population employed. Yes, GDP is growing again and we're adding jobs, and that's a sharp reversal from where we were. But we're not growing fast enough to generate enough jobs to meet the needs of working Americans, and creating more economic uncertainty by screwing around with the debt ceiling, is a great way to ensure that we keep puttering along, at best.

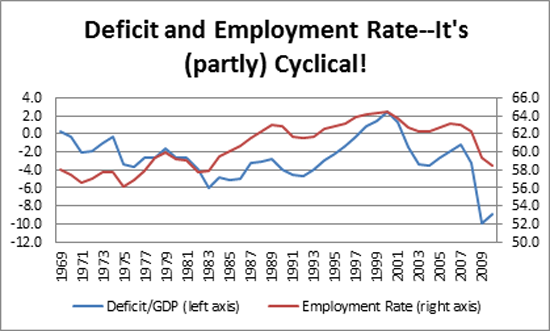

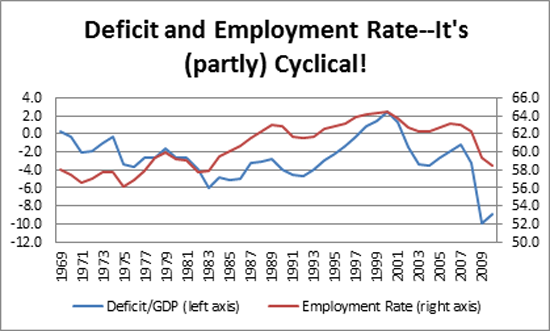

One more thing. These two trends of great concern to us right now--the loss of jobs and the increase in budget deficits--are intimately related. Falling employment rates, or rising unemployment, are associated with larger budget deficits. One begets the other as safety net programs and other measures to offset the contraction ramp up, and as tax revenues, whacked by the downturn, fall.

Here's a picture of it:

We don't have a tough economy because of current budget deficits. To the contrary, our economy is markedly better off because public spending temporarily expanded to partially offset the massive private sector contraction.

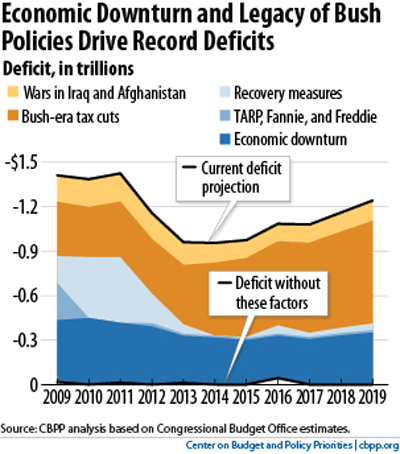

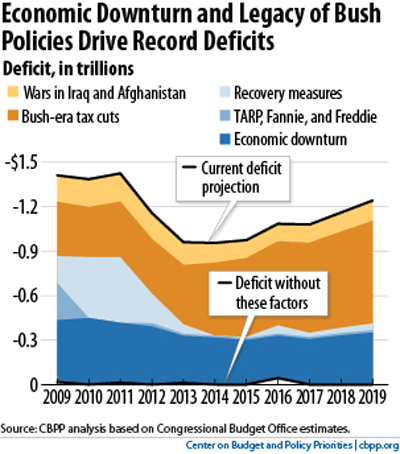

Yes, there's a structural--as opposed to cyclical--deficit problem underneath all this, but as this much-travelled CBPP graph shows, that's much more a function of putting the wars and the Bush tax cuts on the credit card, along with the downturn itself. The stuff designed to get the economy back on track--TARP and Recovery Act--are quickly fading into the sunset. (Too quickly when it comes to stimulus, but that's another issue.)

So stop blaming Obama and spending and the French and socialism and Keynes and the liberal media... and stop screwing around and get your act together and do the right thing. Raise the debt limit and get back to work.

No comments:

Post a Comment