As reported by Arthur Delaney in the Huffington Post:

Further in the article, Congressman Sander Levin's response:

There are some important facts to keep in mind when discussing unemployment insurance.

First and foremost: it's an insurance benefit, meant to cushion the financial blow of having your job taken away through no fault of your own.

Second, this insurance benefit is administered by the states and paid for by a payroll tax on qualified employers.

Third: employers do not pay unemployment taxes on every dollar of a worker's salary. They only pay taxes on part of a worker's salary: the "wages subject to tax". In 2010, the range of wages subject to tax went from a low of $7,000 in six states (AZ, CA, FL, IN, MI and SC) to a high of $37,300 in WA.

So, if you worked in California and your annual salary was $20,000, your employer was taxed on the first $7,000. If you made $50,000, the wages subject to tax stayed the same: $7,000. If you made $1,000,000? Still only the first $7,000 was subject to tax. Keep that in mind when we look at the GOP JOBS Act.

Let's look at California again: they explain how their state's unemployment taxes work very clearly:

Let's look at a few other states:

New York State:

Florida:

Texas:

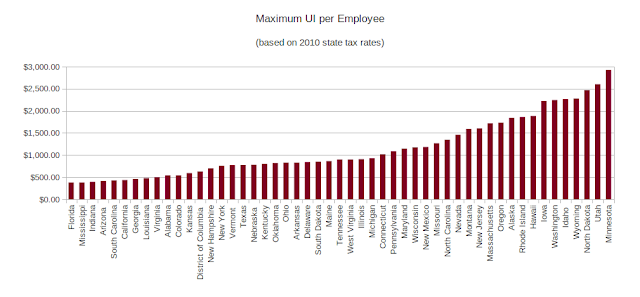

If we looked at all 50 states, and multiplied each state's wages subject to tax by that state's maximum UI tax rate, this is what we'd get:

Notice which state is on the least expensive side of the graph? Florida. They also have one of the country's highest unemployment rates (11.1%), and have passed a bill to slash unemployment benefits, in order to pass the savings on to businesses.

On the most expensive side of the graph? North Dakota, which has the country's lowest unemployment rate (3.6%). The two other states on the most expensive end, Utah and Minnesota, also have unemployment rates well below the national average (7.6% and 6.6%, respectively).

In the one-page "Highlights of the JOBS Act" (PDF) sheet published by the Republicans in the House Ways and Means Committee, the GOP claims that

Someone looking at the facts might argue that the GOP doesn't know what the heck they're talking about. Florida: lowest UI taxes per employee, one of the highest unemployment rates in the nation. ND, UT and MN: the three highest UI taxes per employee, but three of the lowest unemployment rates in the nation.

The next bullet point in the highlight sheet claims that

As discussed several times here, 99 weeks is an arbitrary number, and an insufficient one at that. The employment crisis is going to last much longer than 99 weeks, and the number of people exhausting benefits is growing, not shrinking.

Also, people in North Dakota, where unemployment is exceedingly low, can access up to 26 weeks of state unemployment insurance benefits, and because of the Great Recession, they can qualify for up toan additional 34 weeks of benefits. 60 weeks of benefits isn't automatic. With an unemployment rate of 3.6%, very few people in North Dakota are relying on extended unemployment benefits. When the GOP cites ND as an example of poor targeting, again, they don't know what they're talking about.

Next GOP bullet point:

Interesting use of the word "may" here. First, benefits over and above the first 26 weeks are funded by the Federal government, not by the states. Second, extended unemployment (via the EUC and EB programs) is directly tied to a state's unemployment rate: in other words, to local conditions.

In the same bullet point:

Is there something else the GOP had in mind for unemployment insurance benefits other than paying for unemployment benefits?

Next bullet point: the GOP "solution":

And once again, the almost pathological aversion the GOP has to taxes is made clear. This isn't a bill to promote job growth - it's a bill to further lower taxes on businesses, and in this case, to slash unemployment insurance benefits - to harm those people most in need as a result of the Great Recession.

On to the details section of the one-pager.

The first bullet point here refers to "paying interest or principle on Federal unemployment loans" - but the Federal interest on these loans is zero percent, and President Obama has put forward a proposed two-year extension of the zero-percent interest rate. Why does the GOP expect the states to pay back zero percent interest?

The next point claims that "States will have the ability to decide fewer weeks of benefits make more sense". How cynical is it to name a bill the "Jobs, Opportunity, Benefits, and Services Act" while suggesting that one of the things states can do, because of this bill, is reduce benefits?

The last point: the claim that "by promoting lower taxes and more hiring, it will strengthen the economy and help create more jobs." Mark Thoma addressed this in his article a few days ago, when he said:

The GOP's JOBS Act is nothing more than a cynical exercise, a cruel joke, meant to further cut taxes for those who need the help the least, while placing even more of a financial burden on those who need help the most.

With this bill, the GOP is putting the BS in JOBS.

"Congressional Republicans announced legislation on Thursday that would let states cut unemployment insurance for the long-term jobless and toughen work search requirements for benefits recipients."

Further in the article, Congressman Sander Levin's response:

“This is the opposite of a jobs bill - it is a hatchet job on the unemployment insurance program," said Sandy Levin (D-Mich.), the top Democrat on Ways and Means. "With this legislation, Republicans are proposing to end this year’s guaranteed benefit for the long-term unemployed, just like they’ve proposed ending the guaranteed benefit for Medicare recipients."

There are some important facts to keep in mind when discussing unemployment insurance.

First and foremost: it's an insurance benefit, meant to cushion the financial blow of having your job taken away through no fault of your own.

Second, this insurance benefit is administered by the states and paid for by a payroll tax on qualified employers.

Third: employers do not pay unemployment taxes on every dollar of a worker's salary. They only pay taxes on part of a worker's salary: the "wages subject to tax". In 2010, the range of wages subject to tax went from a low of $7,000 in six states (AZ, CA, FL, IN, MI and SC) to a high of $37,300 in WA.

So, if you worked in California and your annual salary was $20,000, your employer was taxed on the first $7,000. If you made $50,000, the wages subject to tax stayed the same: $7,000. If you made $1,000,000? Still only the first $7,000 was subject to tax. Keep that in mind when we look at the GOP JOBS Act.

Let's look at California again: they explain how their state's unemployment taxes work very clearly:

"UI is paid by the employer. Tax-rated employers pay a percentage on the first $7,000 in wages paid to each employee in a calendar year. The UI rate schedule and amount of taxable wages are determined annually. New employers pay 3.4 percent (.034) for up to three years. EDD notifies employers of their new rate each December. The maximum tax is $434 per employee per year. (Calculated at the highest UI tax rate of 6.2 percent x $7,000.)" (source)

Let's look at a few other states:

New York State:

"Unemployment insurance tax is based only on the first $8,500 of remuneration paid to each employee in a calendar year. Remuneration includes every form of compensation paid to covered employees including salary, cash wages, commissions, bonuses, tips, vacation pay, the reasonable value of meals, rent and lodging, and other types of noncash compensation." (source)

Florida:

"The first $7,000 in wages paid to each employee during a calendar year is taxable. Any amount over $7,000 for the year is excess wages and is not subject to tax." (source)

Texas:

"Taxable wages are calculated and tax paid only on the first $9000.00 of wages paid to each employee during the calendar year." (source)

If we looked at all 50 states, and multiplied each state's wages subject to tax by that state's maximum UI tax rate, this is what we'd get:

|

| (click to enlarge) |

Notice which state is on the least expensive side of the graph? Florida. They also have one of the country's highest unemployment rates (11.1%), and have passed a bill to slash unemployment benefits, in order to pass the savings on to businesses.

On the most expensive side of the graph? North Dakota, which has the country's lowest unemployment rate (3.6%). The two other states on the most expensive end, Utah and Minnesota, also have unemployment rates well below the national average (7.6% and 6.6%, respectively).

In the one-page "Highlights of the JOBS Act" (PDF) sheet published by the Republicans in the House Ways and Means Committee, the GOP claims that

Taxes Hurt Job Creation: Unemployment taxes are payroll taxes on jobs. So these tax hikes are hurting job creation needed to help Americans get back to work.

Someone looking at the facts might argue that the GOP doesn't know what the heck they're talking about. Florida: lowest UI taxes per employee, one of the highest unemployment rates in the nation. ND, UT and MN: the three highest UI taxes per employee, but three of the lowest unemployment rates in the nation.

The next bullet point in the highlight sheet claims that

Federal Unemployment Benefits Are Poorly Targeted: Currently up to 99 weeks of unemployment benefits are paid, including up to 73 weeks paid 100% by the Federal government, an all-time record. But 70% of that Federal spending is poorly targeted, meaning it is spent regardless of how low a State’s unemployment rate is. For example, in North Dakota unemployment is 3.6%, yet the unemployed can collect 60 week of benefits, including 34 weeks paid 100% by the Federal government.

As discussed several times here, 99 weeks is an arbitrary number, and an insufficient one at that. The employment crisis is going to last much longer than 99 weeks, and the number of people exhausting benefits is growing, not shrinking.

Also, people in North Dakota, where unemployment is exceedingly low, can access up to 26 weeks of state unemployment insurance benefits, and because of the Great Recession, they can qualify for up toan additional 34 weeks of benefits. 60 weeks of benefits isn't automatic. With an unemployment rate of 3.6%, very few people in North Dakota are relying on extended unemployment benefits. When the GOP cites ND as an example of poor targeting, again, they don't know what they're talking about.

Next GOP bullet point:

Current Federal law forces States to pay benefits that may make no sense given local conditions

Interesting use of the word "may" here. First, benefits over and above the first 26 weeks are funded by the Federal government, not by the states. Second, extended unemployment (via the EUC and EB programs) is directly tied to a state's unemployment rate: in other words, to local conditions.

In the same bullet point:

Those Federal laws will... prohibit that money from being used for anything other than unemployment benefits lasting up to 99 weeks.

Is there something else the GOP had in mind for unemployment insurance benefits other than paying for unemployment benefits?

Next bullet point: the GOP "solution":

To help States keep unemployment taxes down and promote hiring, Congress should "forward fund" current temporary Federal unemployment funds and give States more flexibility in spending it – not just to pay benefits but also to prevent job-destroying tax hikes.

And once again, the almost pathological aversion the GOP has to taxes is made clear. This isn't a bill to promote job growth - it's a bill to further lower taxes on businesses, and in this case, to slash unemployment insurance benefits - to harm those people most in need as a result of the Great Recession.

On to the details section of the one-pager.

The first bullet point here refers to "paying interest or principle on Federal unemployment loans" - but the Federal interest on these loans is zero percent, and President Obama has put forward a proposed two-year extension of the zero-percent interest rate. Why does the GOP expect the states to pay back zero percent interest?

The next point claims that "States will have the ability to decide fewer weeks of benefits make more sense". How cynical is it to name a bill the "Jobs, Opportunity, Benefits, and Services Act" while suggesting that one of the things states can do, because of this bill, is reduce benefits?

The last point: the claim that "by promoting lower taxes and more hiring, it will strengthen the economy and help create more jobs." Mark Thoma addressed this in his article a few days ago, when he said:

"There are not enough jobs, and ending unemployment benefits won't change that."

The GOP's JOBS Act is nothing more than a cynical exercise, a cruel joke, meant to further cut taxes for those who need the help the least, while placing even more of a financial burden on those who need help the most.

With this bill, the GOP is putting the BS in JOBS.

No comments:

Post a Comment